Introduction

The Indian startup ecosystem has emerged as a vibrant and dynamic arena, capturing the attention of global investors and entrepreneurs alike. Over the past decade, India has become a hub for innovation and technology, with its startups tapping into diverse sectors such as fintech, healthcare, e-commerce, and education. The rapidly expanding market, supported by a young and tech-savvy population, positions India as a compelling destination for investment. However, investing in Indian startups is not without its complexities and challenges.

The allure of investing in Indian startups is multifaceted. Investors are drawn to the country’s large consumer base, burgeoning middle class, and a surge in digital adoption. Moreover, government initiatives and policy reforms have further bolstered interest by creating a favorable environment for startups to flourish. As investors seek to diversify their portfolios and capture opportunities in emerging markets, India offers a promising landscape with high growth potential.

Despite the promising opportunities, investing in Indian startups involves inherent risks. These can range from regulatory hurdles and economic instability to cultural and market dynamics that may be unfamiliar to foreign investors. Understanding these challenges, along with the innovative spirit unique to Indian startups, is crucial for making informed investment decisions.

This article delves into the intricacies of investing in Indian startups. It explores the potential risks and rewards, the nuances of the regulatory environment, and the strategies investors can employ to mitigate risks. By examining success stories and market opportunities, this comprehensive guide aims to provide clarity and insight into the dynamic world of Indian startup investments.

Introduction to the Indian Startup Ecosystem

The Indian startup ecosystem is one of the fastest-growing in the world, transforming the landscape of innovation and entrepreneurship in India. With an impressive number of startups crossing the 60,000 mark as of 2023, India is gaining recognition as a top destination for tech development and creativity. This growth reflects the increasing willingness of the population to embrace entrepreneurship as a viable career path.

Key elements contributing to this ecosystem include a strong talent pool with a robust technical education system and the rise in angel investors and venture capital funds. Cities like Bangalore, Delhi, and Mumbai lead as startup hubs, with various incubation centers and accelerators supporting early-stage startups. Furthermore, initiatives like ‘Startup India’ launched by the government aim to reduce regulatory burdens and provide funding through dedicated schemes, enhancing the ease of doing business.

The ecosystem is characterized by diverse and innovative startups across sectors. From technology-driven businesses like artificial intelligence and blockchain to social enterprises aiming to solve India’s pressing issues, the startup culture is rich with possibilities. This diversity not only increases opportunities for investors but also contributes to significant economic development and job creation in India.

Why Investors are Attracted to Indian Startups

Investors find themselves drawn to Indian startups for several reasons, primarily stemming from the vast growth potential and innovative solutions these startups offer. Here are a few factors making Indian startups attractive to investors:

-

A Large and Growing Market: With a population exceeding 1.3 billion, India presents a substantial market, particularly given its rapidly expanding internet user base. This growth is backed by increased smartphone penetration and widespread adoption of digital services, providing startups with vast opportunities in consumer-centric and B2B models.

-

Government Support and Reforms: Indian government initiatives, such as ‘Make in India’ and ‘Digital India,’ aim to create a conducive environment for startups by simplifying business processes and encouraging foreign direct investment (FDI). Such support makes it easier for startups to establish and scale operations locally and internationally.

-

Thriving Tech Sector: As one of the world’s largest tech hubs, India’s burgeoning startup culture thrives on technological advancements. With numerous unicorns—a term for startups valued over $1 billion—emerging in recent years, the tech sector’s growth potential is a significant draw for investors.

Moreover, India’s diverse cultural landscape provides numerous niche markets that startups cater to, enabling tailored solutions that are scalable not just within the country but on a global scale.

Potential Risks of Investing in Indian Startups

Investing in Indian startups isn’t without its risks. A primary concern for investors is understanding the unique set of challenges these companies face, which can impact the return on investment. Here are some potential risks associated with this market:

-

Regulatory Hurdles: India’s regulatory landscape can be complex, with changing policies and varying state-level regulations. Navigating these regulations requires an in-depth understanding of local laws and compliance, which can be daunting for foreign investors.

-

Economic Instability: Fluctuations in the Indian economy, such as changes in GDP growth rates, inflation, and currency volatility, can impact startup success and investment returns.

-

Competition and Market Penetration: The Indian startup scene is highly competitive, with many players competing in the same space. Establishing a significant market share requires strategic differentiation and robust market analysis.

Regulatory Challenges and Compliance Issues

Regulatory challenges remain a significant concern for investors considering Indian startups. Despite improvements, the business environment in India is still marked by complex regulatory frameworks that can be difficult to navigate.

-

Foreign Direct Investment Regulations: While India has opened various sectors for FDI, some areas still have restrictions and require government approval. Understanding these nuances is crucial for investors planning to inject capital into Indian ventures.

-

Taxation Policies: The tax landscape in India is multifaceted. Compliance with the Goods and Services Tax (GST), income tax, and other local taxes demands thorough planning to avoid penalties and ensure profitable operations.

-

Intellectual Property Protection: Protecting innovative ideas and products is challenging in India due to gaps in IP laws or enforcement. This issue is critical for tech startups that heavily rely on their innovations.

| Regulatory Area | Description | Investor Considerations |

|---|---|---|

| FDI | Sector-specific restrictions on foreign investments | Understanding sector policies and legal complexities |

| Taxation | Complex tax regimes including GST, income tax | Proper tax planning to ensure compliance |

| Intellectual Property | Challenges in protecting innovations and ideas | Ensuring adequate legal protection |

Market Volatility and Economic Factors

Market volatility and economic factors constitute one of the significant risks involved in investing in Indian startups. The Indian economy, although robust, is susceptible to several external and internal forces that can affect startup sustainability and growth.

-

Currency Fluctuations: The Indian Rupee has historically experienced volatility against major currencies like the US Dollar. Such fluctuations can impact investment value and operational costs, particularly for startups engaged in international trade.

-

Economic Policies: Changes in policy can have far-reaching impacts on startups, from legislative reforms to economic sanctions. Staying informed about potential policy shifts is crucial for minimizing risks.

-

Consumer Behavior Changes: Rapid socio-economic changes can lead to shifts in consumer preferences. Startups must be agile and innovative to respond to these changes to maintain a competitive edge.

Unique Opportunities and Innovation in India

India’s startup ecosystem presents a plethora of unique opportunities driven by its intrinsic cultural and demographic diversity. The innovation landscape here is thriving, with startups offering disruptive solutions tailored to local and global needs.

-

Technological Innovations: Indian startups are at the forefront of adopting emerging technologies like AI, machine learning, IoT, and blockchain. These innovations not only cater to Indian needs but are increasingly being recognized on the global stage.

-

Social Enterprises: Startups focusing on social impact are gaining traction, targeting sectors such as healthcare, agriculture, and education. These startups address critical challenges using innovative solutions, often supported by government and global organizations.

-

Rural Markets: India’s vast rural population presents untapped potential. Companies developing affordable and accessible products for rural areas stand to gain significantly in terms of market size and impact.

Understanding Cultural and Market Dynamics

Investing in Indian startups requires an understanding of the diverse cultural and market dynamics that define the country. Here are some of the cultural and social factors investors should consider:

-

Diverse Market Needs: India’s demographic diversity, with its varied languages and customs, requires startups to adopt a localized approach in product development and marketing strategies.

-

Consumer Behavior: The fast-changing consumer behavior, driven by digital adoption and increasing income levels, offers opportunities and challenges. Understanding local consumer mindsets can help in creating effective market strategies.

-

Workforce Dynamics: Indian talent, known for its IT and engineering expertise, is a key asset. However, cultural differences in management and communication styles can impact organizational efficiency and necessitate a nuanced approach.

Risk Mitigation Strategies for Investors

Investors can adopt several strategies to mitigate risks while investing in Indian startups. These include due diligence, seeking local partnerships, and diversifying investments across different sectors and stages.

-

Thorough Due Diligence: Conducting comprehensive research into the startup’s business model, market potential, and legal landscape is crucial for identifying potential red flags.

-

Local Partnerships: Engaging with local partners or advisors who understand the market can help navigate regulatory, cultural, and business challenges more effectively.

-

Diversification: Spreading investments across multiple startups in different sectors and stages of maturity can help in balancing risks and maximizing potential returns.

Success Stories of Indian Startups

Indian startups have produced several success stories that highlight the potential rewards of investing in the Indian market. These stories serve as both inspiration and illustration of the dynamic capabilities of the Indian startup landscape.

Flipkart

Flipkart, founded in 2007, started as an online book retailer and has since evolved into one of India’s largest e-commerce platforms. With strategic funding rounds, acquisitions, and market innovations, Flipkart was acquired by Walmart in 2018 for $16 billion.

Ola Cabs

Ola, founded in 2010, disrupted the transportation industry in India by providing app-based cab services. It expanded not just domestically but also internationally, introducing innovations like EV fleets and bike-taxi services.

BYJU’s

BYJU’s, an edtech startup, transformed learning through its mobile app offering personalized education experiences. It has become one of the world’s leading edtech companies, attracting global investors and significantly impacting education in India.

Long-term Benefits and Wealth Creation

Investing in Indian startups not only offers the potential for substantial returns but also contributes to long-term wealth creation and socio-economic benefits. Here’s why it’s worth considering:

-

Value Creation: Startups are often at the forefront of creating value through innovative solutions, driving sectors forward, and increasing operational efficiencies. This, in turn, leads to higher valuations and return on investment.

-

Economic Impact: Investments in startups contribute to job creation, technological advancements, and GDP growth, positively impacting the overall economy.

-

Cross-border Opportunities: With international expansion, startups offer cross-border investment opportunities, leveraging India’s advantageous position in Asia and beyond.

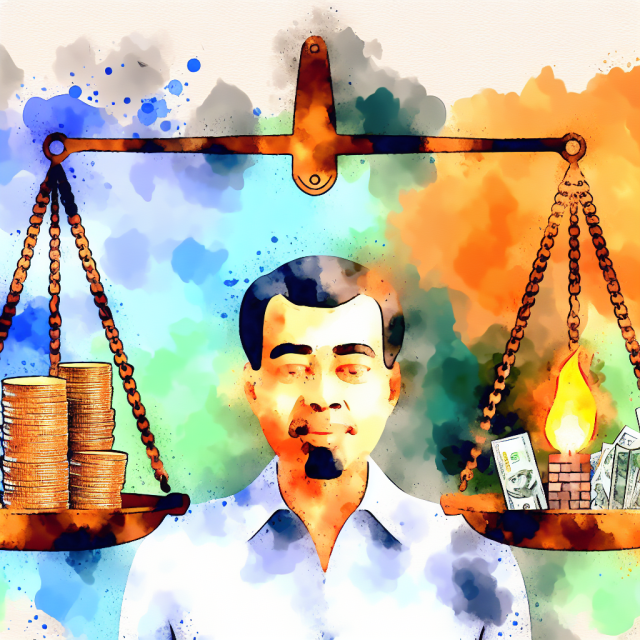

Conclusion: Balancing Risks and Rewards

Investing in Indian startups provides a unique mix of risks and rewards. While the potential for high returns is considerable given the rapid economic growth and innovation landscape, investors must acknowledge and address the risks inherent in this vibrant market.

A strategic approach involving thorough market research, understanding regulatory environments, and forming local partnerships can significantly mitigate potential challenges. Embracing the cultural diversity of India and leveraging the burgeoning tech sector can also enhance investment outcomes.

As investors navigate the intricacies of the Indian startup ecosystem, a balanced perspective that appreciates both the opportunities and the pitfalls is essential. With the right strategies, investing in Indian startups can lead to lucrative rewards and meaningful contributions to technological progress and economic development.

FAQ

1. What are the main sectors for startup investments in India?

The primary sectors include technology, e-commerce, fintech, healthcare, and education. These areas have shown significant growth potential and innovation.

2. How do regulatory challenges affect startup investments in India?

Regulatory challenges can pose risks, including compliance issues and sector-specific investment restrictions, which investors must understand and navigate carefully.

3. Why is there a high interest in India’s startup ecosystem?

India’s large consumer base, digital growth, government support, and thriving tech sector drive high investment interest.

4. What strategies can investors use to mitigate risks?

Investors can mitigate risks through due diligence, building local partnerships, and diversifying investments across sectors and startup stages.

5. Can investing in Indian startups offer long-term benefits?

Yes, besides potential financial returns, investing in startups contributes to economic growth, job creation, and technological innovation.

Recap

- The Indian startup ecosystem is rapidly growing, offering significant investment opportunities.

- Investors are attracted by a large consumer market, government support, and a thriving tech sector.

- Key risks include regulatory challenges, economic instability, and competitive markets.

- Opportunities abound in technology, social enterprises, and rural markets.

- Risk mitigation includes due diligence, local partnerships, and diversification.

- Success stories like Flipkart, Ola, and BYJU’s highlight potential rewards.

- Long-term benefits extend beyond financial gains to economic and social impacts.

References

- Nasscom, “Indian Tech Startup Ecosystem: Leading Tech in the 20’s,” 2023.

- Government of India, “Startup India Initiative,” Digital India, 2023.

- World Bank, “Regulatory Policies and Economic Impact on Indian Startups,” 2023.